RM Rating

- TOP

- Why People Choose Us

- RM Rating

With a rating that is specialized for distinguishing bankruptcies supported by the bankruptcy records of approximately 800,000 companies, we improve the accuracy of

your credit management operations. Since the service started in December 2000, we have been rating huge groups of companies counting about 5.0 million and

statistically calculating and publishing the probability of bankruptcy. This is a proven index.

- Key points

- Specialized in corporate bankruptcy. It is a simple indicator that matches the purpose of credit management.

- Reflecting multi-faceted information. We obtain information from over 30 information resources every day and

analyze them. - Highly accurate rating. About 93.7% of bankrupted companies had been rated low with E or F (the performances

of companies are disclosed monthly).

Definition of the RM Rating

Companies are rated in six levels, A, B, C, D, E, and F (* nine levels including subdivisions). It is a unique credit management index supported by bankruptcy records.

Companies with an A rating have a lower probability of bankruptcy, in other words, they are unlikely to go bankrupt. Companies with an F rating have a higher

probability of bankruptcy, in other words, they are likely to go bankrupt.

| RM Rating | Definition | Estimated probability of bankruptcy |

|---|---|---|

| A | Very high paying capacity | 0.05 to 0.1% |

| B | High paying capacity | 0.5 to 1.0% |

| C | Moderate paying capacity | 1.0 to 1.5% |

| D | There are concerns over the future paying capacity (transactions require some research) |

2.0 to 2.5% |

| E1 | There are concerns over paying capacity (transactions require research) | Approx. 3.0% |

| E2 | Approx. 3.5% | |

| F1 | Unsuitable for normal business transactions (transactions require sufficient research) |

Approx. 5.0% |

| F2 | Approx. 6.0% | |

| F3 | Approx. 7.0% | |

| G | Cannot make a decision |

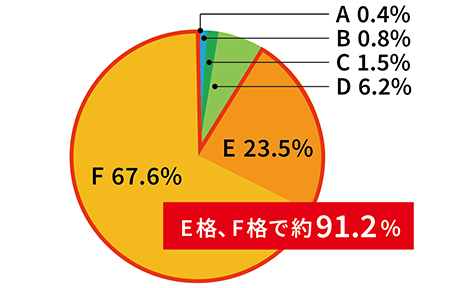

Performance of the RM Rating

The RM rating is a unique indicator backed by bankruptcy records that can statistically calculate the probability of bankruptcy. It also has a very high track record of

being able to distinguish bankruptcy.

- Annual bankruptcy probability (estimated): Ones rated F: 7%

- About 93.7% of companies that went bankrupt were rated E or F at the time!

(Performance between November 2020 and October 2021)

*Undeterminable companies are rated G. (Specifically: 1. Newly established companies; 2. Companies who refused to disclose information; 3. Companies that were last researched a very long time ago; 4. Companies in industries where a rating is not available; and 5. Financial

institutions who carry out operations such as deposits.)

Bankrupt Company Ratings

(November 2020-October 2021 Results)

Logic on Calculating the RM Rating

One of the major features of the RM Rating is that, in addition to making changes by regularly updating data, analysts continue to make corrections on them by collecting and analyzing daily credit information. Since our logic on examination is reviewed twice a year to match the trends in bankruptcies and economic and social conditions, member companies can always confirm the up-to-date index.

Main Analysis 1 Analysis on the creditworthiness of the subject company

We score the data on each of the subject companies based on its management base, profitability, and financial base, and distinguish the company if it is close to

bankruptcy or far from it.

Main Analysis 2 Comparison with bankrupted companies in the past

We develop patterns from the characteristics of company data that appear commonly in about 800,000 companies bankrupted in the past and compare them with the

data on the subject company. We set the rating so that if the company data pattern is close to the pattern of the bankrupted companies, we lower the rating, and

conversely, if the pattern is far from it, we raise the rating.

We conduct multifaceted analyses with items, such as scale, revenue base, capital, financial base, openness, and credit trends.

Main Analysis 3 Timely credit information analyses on the subject companies

Corporate data turn into past information once it becomes data. On the other hand, however, companies are "living things"; their creditworthiness changes day by day. We collect various special and uncertainty information every day, and our specialized analysts analyze it to make timely corrections on ratings and to evaluate the latest creditworthiness.

e-Credit Navigator

You can instantly see the six-level rating (nine

levels in subdivision) indicating whether the

business partner is close to or far from

bankruptcy, and the credit limit for each of them.

e-Management File

Efficient customer management with a cloud

system. It provides extensive analysis reports, too. We collect information every day from about 30 information institutions, capture signs of

dangerous situations, and notify you of any

changes in credit conditions.

Portfolio Service

We can conduct comprehensive analyses of

business partners and reviews of the conditions

at low cost and in a short period of time.

We quantify the credit risk and identify the

whereabouts of the risk by performing analyses based on the list of business partners you

provide to us.

Offensive Monster

This is a service to create a prospective

customer list. You can narrow down and extract data based on 22 items of basic information

that are essential to the list. Since you can

narrow down also by the RM Rating, it is the

best tool for new sales activities.

RM Chinese Company

Navigator

This is a credit record for 10 million Chinese

companies. The researched companies are

assigned the six-level RM Rating from A to F,

which

can be used for credit decisions

by companies

in Japan.

Secured Monster

This is a service to guarantee credit. Among the business partners subject to the RM Rating, you can guarantee each business partner even if it is ranked D, E, F, or G indicating the high

probability of bankruptcy.