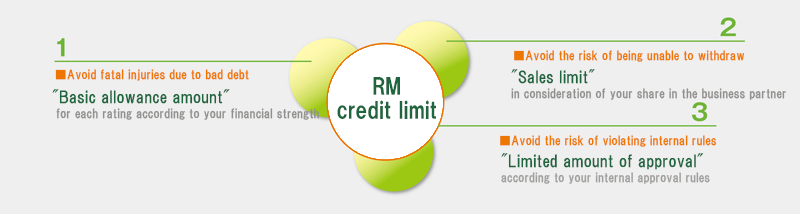

RM Credit Limit

- TOP

- Why People Choose Us

- RM Credit Limit

By analyzing both the condition of your company management and the creditworthiness of your business partner, we provide you with a credit limit that is safe for you.

At RiskMonster, we refer to the financial statements provided by the members and the creditworthiness and scale of the business partners to calculate the amount of the credit limit that is safe for business transactions from the following three perspectives:

- Basic allowable amount for each rating according to your financial strength

- Maximum volume of sales in consideration of the business partner’s share in your transactions

- Maximum amount for approval according to your authority for providing approval

We provide the minimum value among them as the RM Credit Limit.

- This is an index that makes use of the know-how on credit of a general trading company who has been engaged in commercial transactions for many years.

- This is an index that considers both the company and the other party.

- By understanding the appropriate credit amount, you can consider how far you should take measures for the risk.

Definition of the RM Rating

1.Basic allowable amount

When a large amount of bad debt (also known as irrecoverable debts) causes fatal damage that cannot be easily recovered, it will have a major impact on company

management. At RiskMonster, based on the financial statement (data extracted from the financial statement are also acceptable) provided from you, we measure your

financial strength based on the capital strength and the characteristics of the fund turnover. Then, for each rating, we set the maximum amount of credit where you can

challenge the risk.

2.Maximum amount of sales

When a business partner has a large share in your transactions, there is a risk that you cannot take measures even if you collect information: when the business partner

experiences a problem, such as a lack of funds, they may request a payment grace period, and the amount of your credit may increase; and when you try to cancel the

transaction, you may have difficulty withdrawing from it. Based on the rating and scale of the business partner, we calculate the share of transactions that you can credit and adjust the credit limit. When you have a large share in the transactions, it will be indicated with the alarm, "subject to centralized management."

3.Maximum amount for approval

Even if you have sufficient financial strength and share in transactions, when you present a guideline for a credit limit deviating from the company rules, it will confuse

the departments and personnel in the field who work on credit. After consulting with you, RiskMonster will provide a credit limit in accordance with your company rules.

Services to provide RM Credit Limit

You can instantly see the six-level rating

(nine levels in subdivided rating) indicating whether your business partner is close to

bankruptcy or far from it, and the credit limit for each of them.

Efficient customer management with a cloud system. It provides extensive analysis

reports, too.

We collect information every

day from about 30 information institutions,

capture signs of dangerous situations, and

notify you of any

changes in credit

conditions.